Hybrid notes are being phased out by APRA, Australia’s bank regulator.

That is a pity because hybrids have been terrific for investors who want higher returns than term deposits deliver, without too much risk. That is especially true since the RBA flooded the banking system with cash during Covid, making term deposits less attractive.

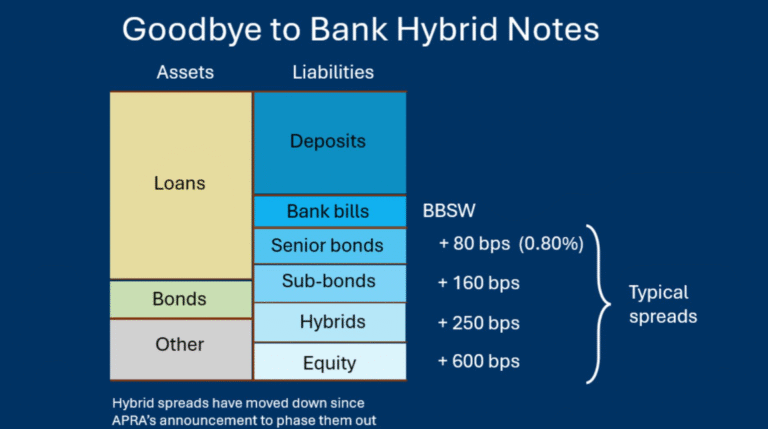

The table below shows how banks finance the loans they make (and other things they own). On the right is the full stack of bank liabilities, ranging with increasing risk, from risk-free deposits through to risky shares (equity).

The yield on bank bills is BBSW (the Bank Bill Swap Rate), the rate at which banks can raise short funds in the money market. It is normally the RBA’s cash rate plus 10 basis points (10 bps or 0.1%).

Hybrids until recently yielded about 250 bps above BBSW. They are down closer to 200bps since APRA’s announcement of phasing out hybrids, but I will stick with the normal spread here.

Bank hybrids are attractive because of their high yield relative to their risk. The simple explanation for that is the high supply of hybrids versus the low demand for them.

The downside of hybrids is that they are complex. The complexity arises because hybrids are a combination of two things: A low-risk note plus a put option.

In a hybrid note, the investor effectively buys a long-term note from the bank, but also sells the bank an option. It is an option to put shares to the investor in return for the note (to discharge the note) if very unlikely and severe banking conditions arise.

If not for this embedded put option, hybrid notes would have the same yield as long-term senior bonds of the bank – about BBSW + 80 bps. The extra 170 bps (1.70%) of yield that hybrids pay is for selling the bank the option to exchange shares for the hybrid in a crisis.

The most misunderstood thing about hybrids is how unlikely it is that the hybrids of a Big4 bank will ever be converted into shares (the low likelihood that the put option is ever exercised). Most pundits and commentators have no way of understanding the embedded options in hybrids.

But, experts can price those embedded options. It is straightforward to show that the extra return on hybrids outweighs the extra risk.

Is there a good substitute for hybrids? See the graph again. The next step up in the stack is the Tier 2 bonds of banks. They are less risky and less complex than hybrid notes, but only offer BBSW + 160 bps (their historical average yield is 180 bps over bank bills).

These Tier 2 bonds are low risk and will suit investors who want a defensive asset with extra yield, especially when yields are 180 bps or more over bills.

Investors can buy ETFs of Tier Bank Bonds, such as the Betashares Australian Major Bank Subordinated Debt ETF (ASX: BSUB).

Copyright September 2024 Sam Wylie