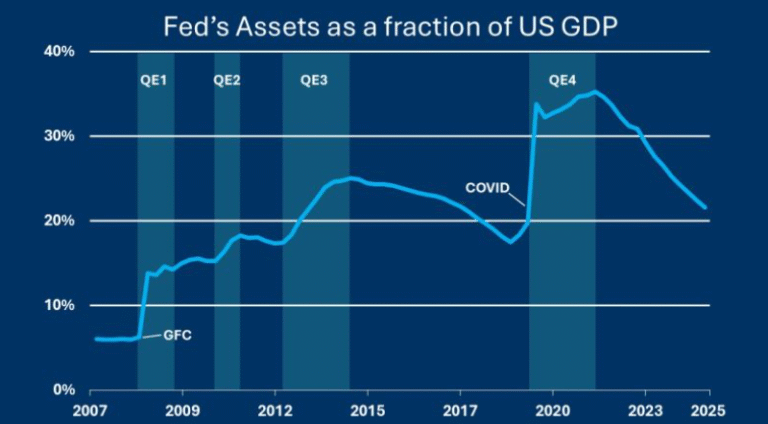

The US Federal Reserve has now unwound almost all of its Covid era Quantitative Easing (QE). The Fed has been conducting QT (Quantitative Tightening) since September 2022. Yesterday the Fed announced that it is winding back its QT program from $60 billion per month to $40 billion per month.

Why is that important to investors? Because QE is the creation of new money which puts upward pressure on share prices (and other long-term assets such as property and infrastructure). When new money is injected into the economy through QE, then someone must hold that money on their balance sheet — a household, an institutional investor, or a corporation.

The average investor does not want more cash so they try to get rid of the new cash by buying long-term assets (stocks, bonds, real estate, etc.), hence driving up the price of those assets.

All the four rounds of QE, in the GFC and then Covid, drove up US share prices immensely. QT does the opposite — it drains liquidity from the system and forces investors to sell long-term assets. So, QT has been putting downward pressure on US share prices since Sep 2022. That effect has been masked by other effects, and especially the AI boom and falling interest rates.

The Fed’s winding back of QT is good news for stocks. But QT goes on at $40 billion per month of withdrawal of money from the financial system. The downward pressure persists, but at a slower rate. As QT continues it will really start to bight at some stage.

To hear more about investing in shares in these uncertain times come to my webinar on March 31.

Copyright Sam Wylie, March 2025