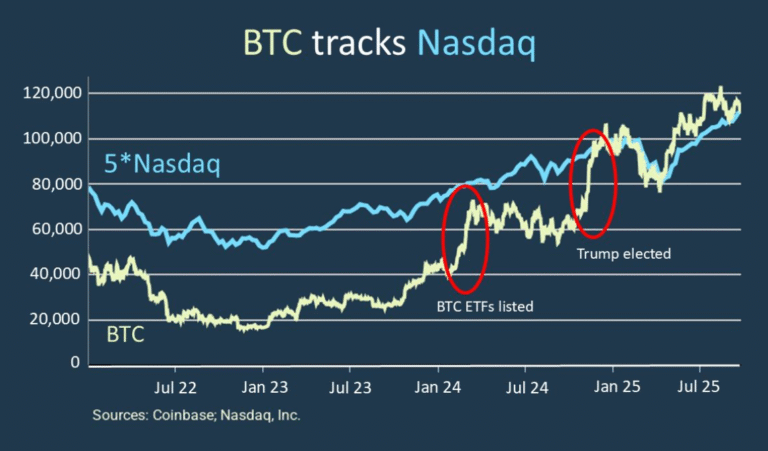

It is remarkable how closely Bitcoin (BTC) has tracked the Nasdaq index since early 2022. The graph below shows the BTC price versus 5 times the Nasdaq.

There are two episodes of BTC jumping up (circled in red) relative to the Nasdaq. First, in early 2024, when BTC ETFs first listed on the US exchanges, giving US investors a much simpler way of investing in BTC. Second, when President Trump was elected in early November 2024.

Apart from those two surges in BTC, the tracking of the Nasdaq by the BTC price is quite striking. In that way, BTC is a proxy for US tech. Obviously, we don’t know whether this correlation will continue, but for now, the correlation is obviously more than a spurious one.

Many investors have come to see BTC as an alternative to gold, as a store of value. In particular, those investors see BTC as a hedge against the time bomb that is US Treasury debt. They emphasize the finite number of BTC (21 million) and expect BTC to hold its real value even if the real value of USD falls in the seemingly inevitable US treasury debt crisis.

I think that is a reasonable argument, and really the only good reason for holding BTC. But investors should be aware of the extra exposure to US tech that BTC brings.

Copyright Sam Wylie 26 September 2025