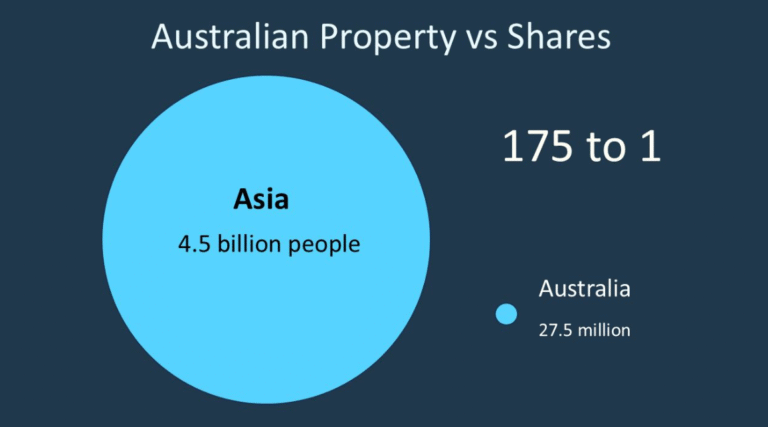

For every person living in Australia, 175 people live in Asia: 4.8 billion versus 27.5 million. That is a dominant fact for investors thinking about whether to favour property or shares in their long-term investment portfolio.

Over time, that leverage will impact property prices more than share prices. That is a big part of why I am more bullish about the long-term prospects for Australian property than Australian shares.

I have worked quite a lot with wealthy families and their advisors in Asia. There are tens of millions of very well-organized, emerging affluent families in Asia who would like to have a stake in Australia. Where a stake means that they own property in Australia, send children to be educated in Australia, and potentially become Australians, and they travel to Australia.

The Australian share market is very much about miners and financials (especially banks). Typically, 60% of the market value of the ASX300 is miners or banks. Demand from Asia certainly increases commodity prices, but that is not about the 175 to 1 ratio. If the population ratio was 300 to 1 or 50 to 1, that would not change commodity prices.

In contrast, the effect of demand from Asia for Australian residential and commercial property actually is about that ratio. The rise of affluent families in Asia wanting a stake in Australian property, with its inherently low supply, will put upward pressure on Australian property prices for decades to come.

That consideration feeds into the allocation of Australian investors to Australian shares versus property. A higher long-term allocation of investible wealth to property.

Copyright Sam Wylie, 18 September 2025