Most investors don’t borrow to invest in shares. Instead, they borrow to invest in property. But for some investors, borrowing against home equity to buy shares is the right move.

They might be too far to the left on the risk spectrum and want to take more risk. That happens to many investors who spend their whole investment journey paying down the mortgage on their first home and then paying down the mortgage on a much nicer home.

They then have a lot of equity in their home but not much else, and the paying down of debt has put them a long way to the left on the risk spectrum.

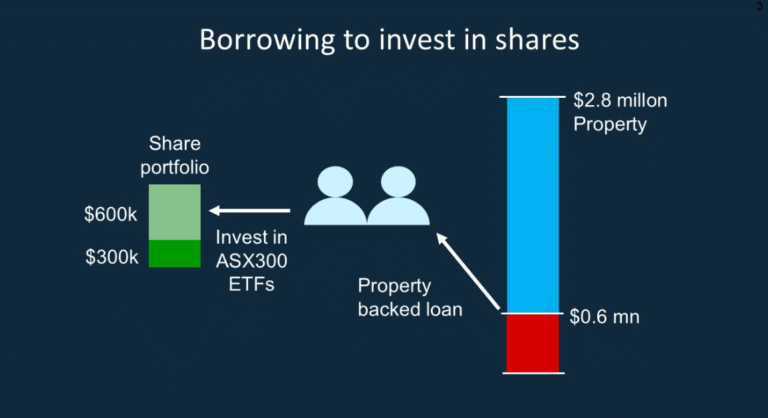

In my video that you can watch HERE, I work through the example of a couple who release equity from their home to buy Australian shares. Not only do they close the gap between where they should be on the risk spectrum and where they currently are, but they also gain the extra return from turning income into capital gains.

The video compares the different ways of borrowing to invest in shares: Borrowing against home equity versus broker margin loans versus geared ETFs. Home equity loans have the big advantages of no margin calls and lower interest rates. There is however, a role for low-gearing, low-fee ETFs.

Copyright Sam Wylie 9 Oct 2025