The short answer is No. There is always a better way to use your savings than paying down your HECS. You have to make the compulsory repayments, but don’t make any extra payments.

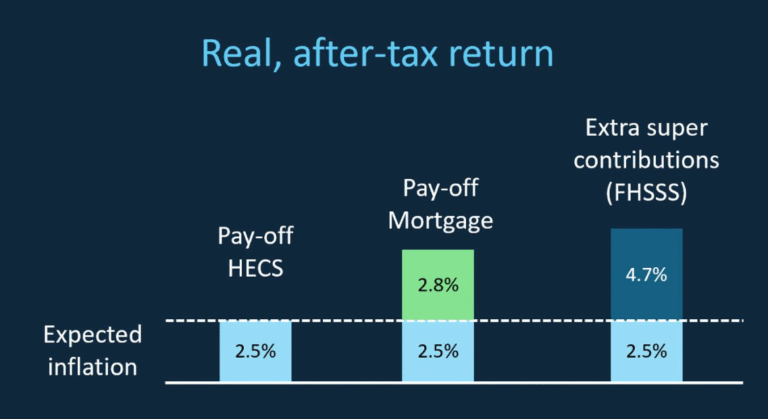

Paying down debt is a form of saving. What is the after-tax return to paying down debt? It is the interest rate on the debt. The interest rate on HECS debt is the inflation rate. That is the rate at which your HECS debt increases. So, the real (after-inflation), after-tax return to paying down HECS debt is zero.If you are saving for a deposit to buy your first home then put your pre-tax money into the First Home Super Saver Scheme and then withdraw up to $50k for your deposit.

If you have a mortgage then pay off your mortgage instead of paying off HECS debt. Your real, after-tax return will be about 2.8% (Real interest rate of 1% plus a bank spread of 1.8%).

HECS is a loan from the Federal Government with a real interest rate of zero. You should want more of that cheap debt and not less. See my Youtube videos on this topic and the First Home Super Saver Scheme on my Youtube channel HERE.

Copyright August 2024 Sam Wylie