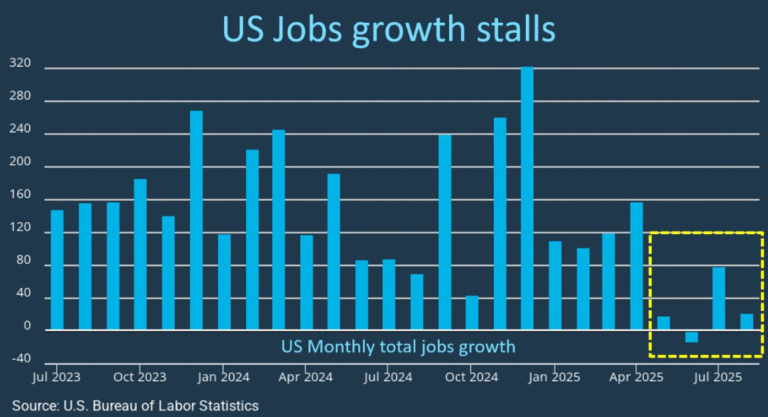

The US economy is sending very mixed signals. Growth in Q2 was revised upwards to a healthy 3.3%; and consumer confidence is up (from a low base). But core inflation is trending up; and unemployment is up (only to 4.3%). More significantly, jobs growth is way down, as shown in the graph below.

That macro uncertainty is one of three factors that give me pause in regards to investing in US stocks at the moment:

1.President Trump’s attempted takeover of the Fed – Fed Governor Jerome Powell’s term does not expire until May 2026. But, if inflation continues to rise as tariffs are passed onto US consumers, and the bond markets conclude that Trump’s replacement for Powell will not be committed to fighting inflation, then there will be a bond market revolt which will hit US stocks hard.

2.There is a material likelihood that inflation rises and growth stalls over the next 6 months. It will only take a whiff of stagflation to send share prices down sharply.

3.Perceptions that the AI transformation has hit a flat spot.

I know that sounds unusually bearish for me. I am not turning bearish, but there is good reason for caution. If you are sequencing into US stocks, then just extend the time frame for doing that by 50%. If you are underweight US stocks, then take advantage of any sharp downturn to get fully invested. Have your trigger points for levels of investment in place.

Copyright Sam Wylie September 2025