The AFR reported today that CBA cut its term deposit rates by 0.50% (50 basis points) and other banks are following.

The AFR article attributes this to the banks getting ready for a cut in the Cash Rate. However, there is something else going on with deposit rates as shown in the two charts below, which are from the RBA.

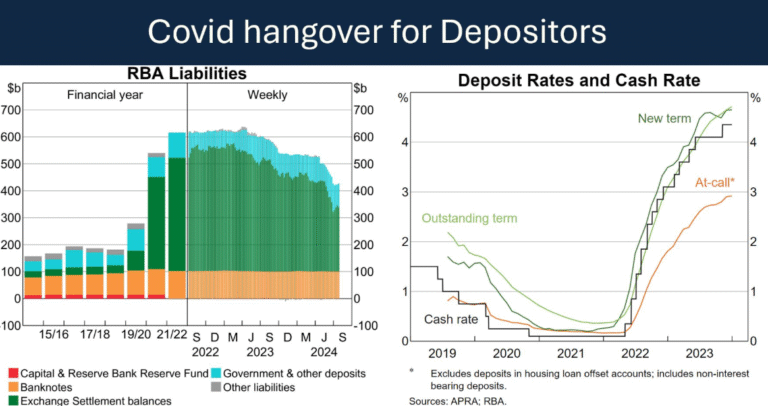

The chart on the right shows that deposit rates offered by banks are much lower post-COVID than pre-COVID. That is especially true of at-call deposits.

The chart on the left shows a major reason for this – banks don’t need as much liquidity as pre-COVID. There is still a vast amount of liquidity in the banking system leftover from the RBA’s quantitative easing (QE) program during COVID.

During COVID the RBA purchased about $300 billion of bonds and paid for them with newly created money that mostly ended up with banks.

The banks then deposited the money back into the RBA. The RBA is the banker’s bank and Australia’s banks still have about $220 bn deposited at the RBA.

The banks don’t need your money as much as they did pre-covid. And that shows in very low deposit rates.

This COVID hangover in the banking system will take many years to unwind (until the purchased bonds mature) and depositors will suffer until it does.

For those interested in deepening their financial knowledge, my next Finance Education for Investors course starts on October 7th. Learn more and register at windlestone.com.au.

Copyright September 2024 Sam Wylie