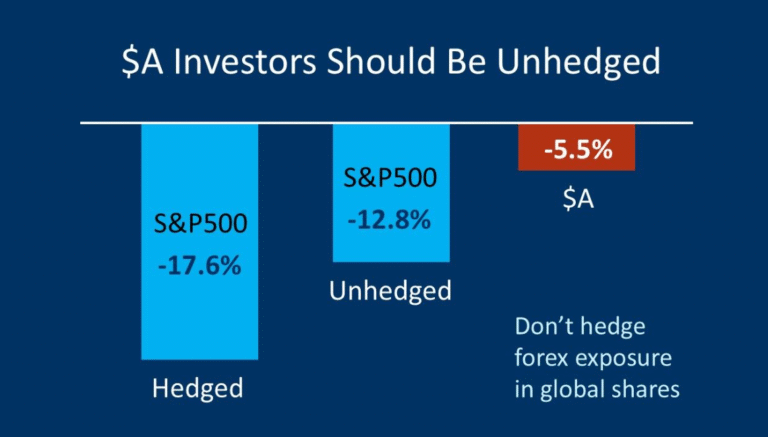

The collapse in global share markets shows clearly why Australian investors in global shares should be unhedged against foreign currency shifts. An unhedged $A investor has experienced a fall of only 12.8% in their US shares, from their peak value, versus 17.6% for a hedged investor. That’s because an unhedged investor has benefited from the fall in the $A versus the $US. The investor’s $US converts into more $A.

It is normal for the $US to rise, in the flight to safety, when the markets are panicked. It doesn’t matter that the problem started in the US. Think of the Covid crisis or the GFC — the same thing happened. A fall in the $A mitigates falls in US share values.

Another consideration in this case is that higher tariffs in the US will put more upward pressure on inflation in the US than Australia, which will keep US interest rates higher for longer, which will in turn keep the USD higher for longer.

Most ETFs for investing in global shares are unhedged for forex and that is what investors like you and me want. We have mostly $A assets and $A income and the ownership of foreign assets hedges part of the risk of a fall in the $A.

Unfortunately, most of the large super funds hedge out at least half of their $A risk in foreign shares. That is not in the interest of members who benefit from lower $A exposure. The super funds do it because they don’t want to take positions that are very different to those held by their peer group of other super funds. It would be much better if the super industry regulator APRA encouraged super funds to not hedge their $A exposure.

Copyright Samuel Wylie April 2025